A land appraisal is the process of determining the market value of a piece of land, typically conducted by a certified appraiser. The appraisal considers various factors to estimate the land’s worth, whether for sale, development, taxation, Insurance or financing purposes. Here’s a detailed breakdown:

1. Purpose of the Appraisal

- Buying or Selling: To determine a fair purchase price.

- Loan or Mortgage: To secure financing, where the lender requires the value of the land as collateral.

- Taxation: To establish property tax values.

- Development: To analyze the feasibility of a project on the land.

- Eminent Domain: To assess compensation for land taken by the government.

- Insurance Purposes: To assess the land value compared to one with improvements.

2. Factors Considered

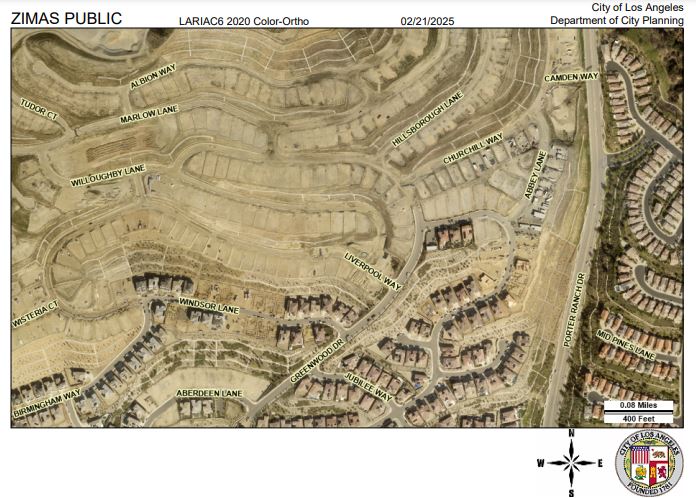

- Location: Proximity to surounding neighborhoods, amenities, freeway access and infrastructure.

- Size and Shape: Larger parcels may have higher values, though irregular shapes can affect usability.

- Zoning and Land Use: Permitted uses (e.g., residential, commercial, agricultural) influence the value.

- Topography and Soil Quality: Flat, well-drained land suitable for construction or farming is often valued higher.

- Utilities and Access: Availability of water, electricity, sewage, and ease of access improve valuation.

- Environmental Conditions: Wetlands, flood zones, or contamination can lower value.

- Comparable Sales (Comps): Recent sales of similar properties in the area provide a market benchmark.

- Market Trends: Economic conditions, supply and demand, and development in the area.

3. Appraisal Process

- Inspection: The appraiser visits the site to evaluate its condition and features.

- Research: Analyzing zoning regulations, market trends, and comparable property data.

- Valuation Methods:

- Sales Comparison Approach: Comparing the land to recently sold, similar properties.

- Cost Approach: Estimating the cost of improvements (if applicable) and subtracting depreciation.

- Income Approach: Used if the land generates income (e.g., through leases or interim use).

- Report Preparation: The appraiser compiles findings in a detailed report, outlining the land’s value, reasoning, and supporting data.

4. Deliverables Reports and uses

- Appraisal Report: Includes the final valuation, methodologies used, and a summary of factors influencing the valuation.

- Intended Use: The report specifies the purpose, whether for sale, taxation, insurance negotiations or legal proceedings.

5. Importance of an Accurate Appraisal

- Ensures fair pricing for buyers and sellers.

- Protects clients from over or under valued collateral.

- Assists in planning and budgeting for development projects.

- Prevents disputes in legal or tax matters.

In summary, a land appraisal is a crucial step in understanding the value of a property, enabling informed decisions for various real estate and financial purposes.